Investing in real estate has long been considered a lucrative venture, offering a plethora of opportunities for generating passive income and achieving long-term appreciation. Whether you’re a seasoned investor or just starting out, there’s a myriad of strategies to tap into the real estate market and reap its benefits. In this comprehensive guide, we’ll delve into various avenues for real estate investment, ranging from traditional rental properties to modern online platforms, providing you with insights to make informed decisions and maximize your returns.

Understanding Real Estate Investment

Understanding Real Estate Investment

Real Estate Investment involves acquiring properties with the intent of generating income or achieving capital gains. Unlike stocks and bonds, real estate offers tangible assets that can provide stable cash flow and serve as a hedge against market volatility. With careful planning and strategic execution, real estate investment can diversify your portfolio and unlock new avenues for wealth accumulation.

Types of Real Estate Investments

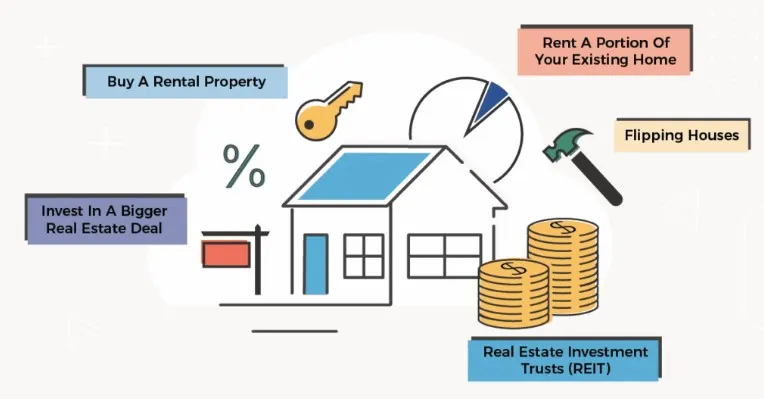

- Rental Properties: Purchasing rental properties is a classic way to invest in real estate. By leasing out residential or commercial units to tenants, investors can enjoy steady rental income while potentially benefiting from property appreciation over time. However, managing rental properties requires time, effort, and a thorough understanding of landlord-tenant laws.

- House Hacking: House hacking involves renting out a portion of your primary residence to offset housing expenses. This strategy allows homeowners to leverage their existing property to generate additional income without the need for significant upfront investment. Whether it’s renting out a spare room or converting a basement into a separate unit, house hacking offers a practical approach to real estate investment.

- Real Estate Investment Trusts (REITs): REITs are publicly traded companies that own and manage income-generating properties, such as apartments, office buildings, and shopping centers. By investing in REITs, individuals can gain exposure to the real estate market without the hassle of property management. REITs offer liquidity, diversification, and the potential for attractive dividends, making them a popular choice among investors seeking passive income.

- Real Estate Crowdfunding: Online real estate investing platforms enable investors to pool their funds and participate in various real estate investment projects. From residential developments to commercial properties, crowdfunding platforms offer opportunities to invest in a diversified portfolio with relatively low capital requirements. However, investors should conduct thorough due diligence and assess the risks associated with each project before committing funds.

- House Flipping: House flipping involves purchasing distressed properties, renovating them, and selling them for a profit. While house flipping can yield substantial returns, it requires expertise in property evaluation, renovation management, and market analysis. Successful house flippers must navigate market fluctuations, manage project timelines, and mitigate risks to optimize their profits.

Benefits & Challenges of Real Estate Investment

Real estate investment offers a range of benefits and presents several challenges. Let’s explore each aspect in detail:

Benefits of Real Estate Investment:

- Potential for Passive Income: One of the primary advantages of investing in real estate is the potential to generate passive income. Rental properties, in particular, can provide a steady stream of income through monthly rent payments from tenants. This income can supplement your primary source of income and provide financial stability over the long term.

- Portfolio Diversification: Real estate serves as a tangible asset class that can diversify your investment portfolio beyond traditional stocks and bonds. Diversification helps spread risk and reduces the overall volatility of your investment portfolio. Real estate investments tend to have a low correlation with other asset classes, offering a hedge against market downturns.

- Tax Advantages: Real estate investment offers various tax benefits that can help minimize tax liabilities and increase overall returns. Investors can deduct expenses such as mortgage interest, property taxes, insurance premiums, maintenance costs, and depreciation from their taxable income. Additionally, investors can benefit from capital gains tax deferral through strategies like 1031 exchanges.

- Long-Term Appreciation: Historically, real estate has shown the potential for long-term appreciation in value. Property values tend to appreciate over time, driven by factors such as inflation, population growth, economic development, and supply and demand dynamics. Investing in properties with strong growth prospects can yield substantial returns over the years.

- Inflation Hedge: Real estate is often considered an effective hedge against inflation. As the cost of living increases, property values and rental income typically rise as well. Real estate investments can help preserve purchasing power and maintain the real value of your investment portfolio in inflationary environments.

- Control Over Investment: Unlike other investment vehicles like stocks or mutual funds, real estate investments offer investors greater control and autonomy over their assets. Investors can directly manage their properties, make strategic decisions, and implement value-adding initiatives to enhance property performance and maximize returns.

Challenges of Real Estate Investment:

- High Upfront Costs: Acquiring real estate assets often requires significant upfront capital investment. Purchasing properties involves expenses such as down payments, closing costs, property inspections, and renovation costs. These high initial costs can pose a barrier to entry for some investors and may limit investment opportunities.

- Property Management: Managing rental properties can be time-consuming and labor-intensive. Property owners are responsible for tenant screening, lease agreements, rent collection, property maintenance, repairs, and addressing tenant concerns. Property management requires effective communication, organizational skills, and a hands-on approach to ensure optimal property performance.

- Market Volatility: The real estate market is subject to fluctuations and cyclical trends influenced by economic conditions, interest rates, demographic shifts, and regulatory changes. Market volatility can impact property values, rental demand, occupancy rates, and investment returns. Investors must conduct thorough market research, assess risk factors, and develop contingency plans to navigate market uncertainties effectively.

- Liquidity Constraints: Real estate investments are relatively illiquid compared to other asset classes like stocks or bonds. Selling a property can be time-consuming and may require finding a suitable buyer, completing legal documentation, and finalizing the transaction. Illiquidity can limit investors’ ability to access funds quickly, especially during financial emergencies or market downturns.

- Property-Specific Risks: Each property investment carries unique risks and challenges that investors must consider. These risks may include property damage, natural disasters, tenant disputes, regulatory compliance issues, zoning restrictions, and environmental liabilities. Conducting thorough due diligence, obtaining property insurance, and implementing risk mitigation strategies are essential to mitigate property-specific risks.

- Economic and Regulatory Factors: Real estate investments are influenced by broader economic trends, government policies, and regulatory frameworks. Changes in interest rates, tax laws, zoning regulations, and housing policies can impact property values, rental markets, financing options, and investment returns. Investors must stay informed about economic and regulatory developments and adapt their investment strategies accordingly.

Despite these challenges, real estate investment remains a viable wealth-building strategy with the potential for attractive returns and portfolio diversification. By understanding the benefits and challenges of real estate investment, investors can make informed decisions, mitigate risks, and capitalize on opportunities in the dynamic real estate market.

Strategies for Successful Real Estate Investment

- Set Clear Investment Goals: Define your objectives, whether it’s generating passive income, achieving capital gains, or diversifying your portfolio. Tailor your investment strategy to align with your financial goals and risk tolerance.

- Conduct Thorough Research: Research potential investment opportunities, analyze market trends, and assess the financial viability of each property. Consider factors such as location, demographics, rental demand, and future growth prospects.

- Diversify Your Portfolio: Spread your investments across different property types, locations, and investment vehicles to minimize risk and maximize returns. Balance high-yield assets with stable, income-generating properties to create a well-rounded portfolio.

- Due Diligence and Risk Management: Perform comprehensive due diligence on prospective properties, including property inspections, financial analysis, and legal documentation review. Mitigate risks by investing in reputable projects with strong fundamentals and established track records.

- Seek Professional Advice: Consult with real estate professionals, financial advisors, and legal experts to gain insights into market dynamics, investment strategies, and regulatory compliance. Leverage their expertise to make informed decisions and optimize your investment portfolio.

Real estate investment offers a diverse array of opportunities for individuals seeking to build wealth, generate passive income, and diversify their investment portfolio. Whether you’re a novice investor or seasoned entrepreneur, there are numerous avenues to tap into the real estate market and unlock its potential. By understanding the fundamentals of real estate investment, conducting thorough research, and adopting a strategic approach, you can navigate the complexities of the real estate market and achieve your financial goals. Remember to stay informed, stay vigilant, and seize opportunities to capitalize on the ever-evolving landscape of real estate investment.

Additional Considerations for Real Estate Investment

In addition to the core strategies outlined above, there are several other considerations to keep in mind when investing in real estate:

- Location Analysis: The location of a property can significantly impact its investment potential. Factors such as proximity to amenities, transportation hubs, schools, and employment centers can influence rental demand and property appreciation. Conduct thorough market research to identify high-growth areas and emerging real estate markets.

- Property Management: Effective property management is essential for maximizing returns and maintaining tenant satisfaction. Whether you manage your properties yourself or hire a professional property management company, ensure that properties are well-maintained, tenants are screened rigorously, and rental income is collected promptly.

- Financial Planning: Real estate investment requires careful financial planning to ensure profitability and mitigate risks. Develop a detailed budget that accounts for property acquisition costs, ongoing expenses, and potential contingencies. Consider factors such as property taxes, insurance premiums, maintenance costs, and vacancy rates when estimating cash flow projections.

- Market Trends and Economic Indicators: Stay abreast of market trends, economic indicators, and regulatory changes that may impact the real estate market. Monitor factors such as interest rates, inflation rates, unemployment rates, and demographic shifts to anticipate market dynamics and make informed investment decisions.

- Exit Strategies: Develop exit strategies for each investment property to optimize returns and minimize losses. Whether it’s selling the property, refinancing the mortgage, or transitioning to a new investment strategy, having a clear exit plan ensures flexibility and adaptability in changing market conditions.

By incorporating these additional considerations into your real estate investment strategy, you can enhance your chances of success and achieve your financial goals effectively. Remember to continuously evaluate and adjust your investment strategy based on evolving market conditions and your individual risk profile. With diligence, perseverance, and strategic planning, real estate investment can serve as a powerful wealth-building tool and create lasting financial prosperity.